Services

Our Services

Residential

Escrow Settlement

Ultra Escrow’s highly qualified team of professionals ensures that all requirements are met by parties involved in real estate purchases and refinance transactions. Purchasing a home is probably the most important investment you’ll ever make. With Ultra Escrow you can be confident that your escrow transaction will be handled professionally and diligently.

Read More

Commercial

Escrow Settlement

Commercial Escrow Settlement involves the transfer or encumbrance of property other than residential, such as an office building, apartment complex, retail centers, industrial properties and note sale transactions. Ultra Escrow recognizes that there are unique needs for the handling of commercial real estate escrow and note sale transactions.

Read More

Real Estate Owned

(REO)

REO or foreclosure escrow transactions are different from standard real estate escrow and require a specialized and experienced escrow approach. These capabilities ensure adherence to sale conditions, typically owned by a bank or financial institution. REO is a class of property owned by a lender, typically a bank. It is imperative to recognize that the REO seller is often a corporate lending institution, dealing with a huge volume of properties.

Read MoreShort Sales

What is a short sale? A short sale refers to a transaction in which the sale price falls short of the balance owed on the properties loan and closing costs. The Lender then ultimately decides to sell the property for less than the actual amount due. The lender agrees to accept the equity available in the property with the understanding that the Seller receives no proceeds from the sale of the property.

Read More

Commercial & Note Transactions

Escrow Settlement

Commercial Escrow Settlement involves the transfer or encumbrance of property other than residential, such as an office building, apartment complex, retail centers, industrial properties and note sale transactions. Ultra Escrow recognizes that there are unique needs for the handling of commercial real estate escrow and note sale transactions.

Read More

Refinance

The process of refinancing can frequently be a troubling process. This process often requires a proactive approach to resolve pending problems and hurdles to the closing process. Refinancing involves the payoff of an existing loan with the proceeds from a new loan. Common reasons to refinance include reducing the term of a mortgage, reducing monthly costs by way of lowering the annual interest rate and changing from a adjustable rate to a fixed term.

Read More

Reverse Mortgage

A reverse mortgage is a loan available to homeowners, 62 years or older, that allows them to convert part of the equity in their homes into cash.

The product was conceived as a means to help retirees with limited income use the accumulated wealth in their homes to cover basic monthly living expenses and pay for health care. However, there is no restriction how reverse mortgage proceeds can be used.

Read More

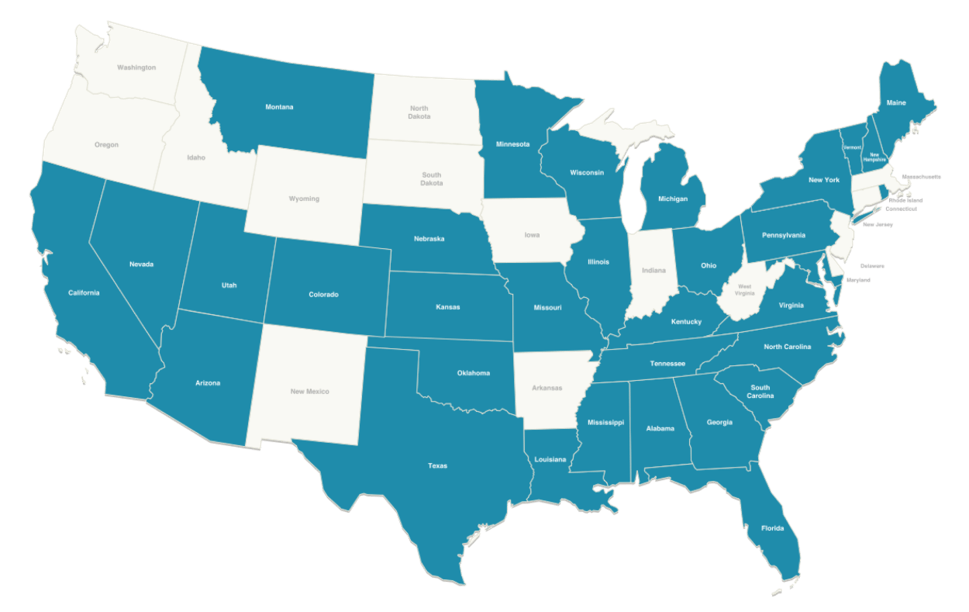

Area's We Service

Ultra Escrow services California, Arizona and Nevada- One point of contact

- High Volume Capacity with ample resources to grow

- Management and Team Leads readily accessible

- Knowledgeable closing staff with relevant REO History

- Closing Teams dedicated to specific Clients/Servicers

- Customer Service staff providing quality support

- Proactive Pipeline Management

- Timely communication delivery and response

Read More

- One point of contact

- High Volume Capacity with ample resources to grow

- Management and Team Leads readily accessible

- Knowledgeable closing staff with relevant REO History

- Closing Teams dedicated to specific Clients/Servicers

- Customer Service staff providing quality support

- Proactive Pipeline Management

- Timely communication delivery and response